Alex Riser, branch manager of Southern AgCredit’s Gulfport location, has overseen exponential growth in the Mississippi coastal region. What’s the secret to his success? It’s likely a combination of his experience as an avid outdoorsman, agricultural real estate broker and dedicated family man. In this blog learn more about how Alex uses his life and work experiences to benefit Southern AgCredit’s borrower-owners.

Where are you from?

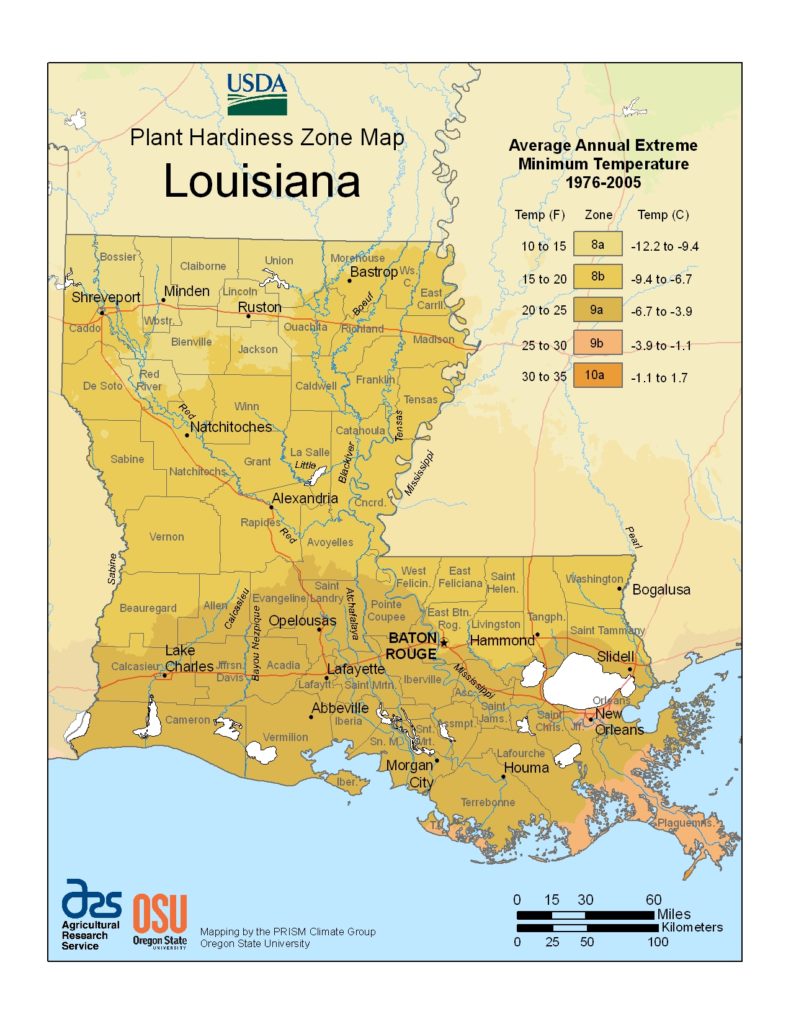

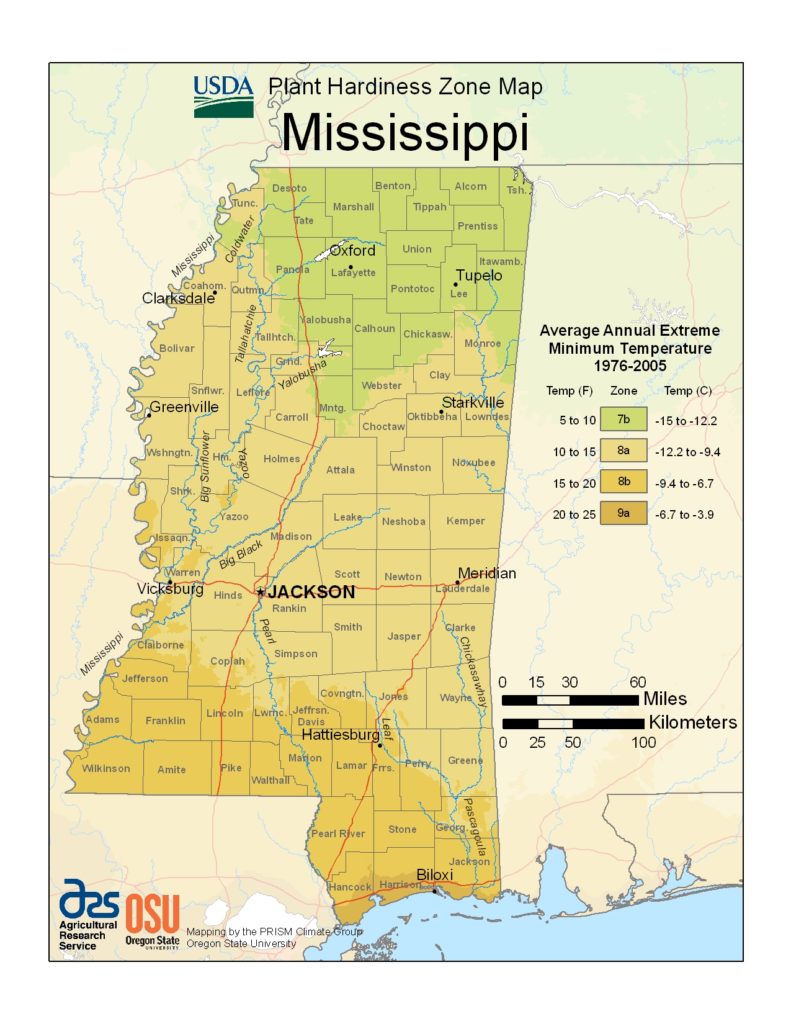

Alex: I was born in New Orleans, Louisiana and raised in the small town of Picayune, Mississippi.

Tell us about your family.

Alex: My mother was originally from Canada. She was a registered nurse, took the big step on her own and moved down to New Orleans. She passed away in 2018. She was the first love of my life and I miss her dearly.

My dad is from Shreveport, Louisiana and is a primary care doctor in Picayune. He has been there for over 35 years. Not only is he my dad, he is a borrower of Southern AgCredit. He’s not my personal customer (we can’t work with family directly), but he is a stockholder and borrower within SAC.

My wife, Allison, and my son, Denson—they’re my whole world. Denson is two-and-a-half years old.

Describe your father’s property that he financed with Southern AgCredit.

Alex: He’s owns 300 acres in Holmes county. It’s hunting and recreational property. The property also has some farmland that we lease to a local farmer for row crops. It has a 20-acre lake on it. My dad’s a diehard freshwater fisherman. He loves putting his boat in the water and fishing for bass.

My wife, son and I will usually load up in the truck to drive three and a half hours to stay for a weekend. My dad built a camp for the whole family to enjoy. I have an older brother with three children and a younger brother. It gives us all a place to go and relax. We all love being outdoors.

You’re an outdoorsman?

Alex: Absolutely. I live and die by it. For the past ten years, I’ve taken the first week of November off for a whitetail deer hunt in the Midwest. I do most of the managing of my dad’s 300 acre property from a biology standpoint, including hunting, food plots and running tractors.

“I’ve probably hunted every part of Mississippi that you can hunt, so I believe I have some words of wisdom when people are looking at recreational tracts.”

Besides outdoor recreation, what else do you like to do away from work?

Alex: We’re big-time sports fans. We love watching college football. We love baseball—I’m a big baseball guy and played baseball in college. We always enjoy going to baseball games, whether at a high school, a local junior college that I played at in Poplarville, or Southeastern Louisiana University where my brother is the head baseball coach.

If I’m not mowing grass, most of my time on the weekends is spent with Denson and Allison—goofing around and watching him grow during these early stages.

Tell me about your position at Southern AgCredit.

Alex: I was the assistant vice president of lending, then in January of 2021 I was promoted to vice president. I am also the branch manager of the Gulfport branch down on the coast.

My role here is a bit of everything, but my biggest focus is growing the branch. Every day I oversee branch operations like reports and finances, and my goal is to find new loans in order to help us continue to grow.

That is how we’ve been able to increase our portfolio. After my first full year in 2018, we finished right at $9 million in new loan volume. Then in 2019, we were an $11 million branch. In 2020, we had a record-breaking year as a $17 million branch. So, we’ve grown exponentially and that is through being able to diversify our portfolio and finance loans in rural areas.

What is Southern AgCredit’s Gulfport office like?

Alex: We just completed a renovation project for our branch office. So, when I talk about our branch growing, we’re growing not only on paper in numbers and the amount of loans in our portfolio, we’re also growing physically in size. The project added 2,000 square feet to our building for an additional three new offices. We were able to hire a new loan officer and a new loan administrator for the Gulfport branch.

I am a firm believer in leaving something better than you found it—I believe that our branch is headed in that direction. I have long-term goals at Southern AgCredit that I want to achieve. We are able to see our growth on paper and then physically in our expansion progress and additional staff. Right now we’re reaping the benefits of our hard work.

What did you do before you came to Southern AgCredit?

Alex: Before I joined Southern AgCredit, I spent almost ten years in real estate.

I started my career with an agricultural / real estate company in Madison, Mississippi. Then, I wanted to go to the corporate side. So I started working with Mossy Oak Properties. I earned my accreditation as a Certified Land Specialist through Mossy Oak Properties’ Certified Land Specialist training program.

After Mossy Oak Properties, I helped start an ag real estate company and served as managing broker of 4 Corner Properties, which is a company that is still thriving today.

How does your real estate experience help you with the customers at Southern AgCredit?

Alex: The relationships I made in the real estate world are what I hold responsible for the growth here in Gulfport. I still have a lot of friends who are still working in real estate. They rely on me and I rely on them. Before, I only had a view of this from the real estate side, but now I’ve got a full view coming in on the lending side.

A prime example: this morning we closed a loan with a realtor whom I used to do deals with. During the closing he was a little confused on some title details. Back when I was in his shoes, I would not have understood those details either.

Thanks to being on this side, I was able to speak his language and tell him how to fix it. They appreciate my knowledge coming from the other side of the table, so to speak.

Does your experience as an outdoorsman help your customers at Southern AgCredit?

Alex: If I were not an outdoorsman, I don’t think I could do what I do. It all goes hand-in-hand.

My portfolio is mostly hunting and recreational land, so every day I walk in thinking about either deer, ducks, or turkeys in some form or fashion. It’s not necessarily always about hunting, but the conservation aspect.

I’ve hunted probably every part of Mississippi that you can hunt, so I believe I have some words of wisdom when people are looking at recreational tracts. People can call me and ask for my advice on a piece of property that could be anywhere in Mississippi.

We covered a lot of what makes a good tract in our recent blog, Guide to Buying Hunting Land.

Alex: Borrowers will call me, especially about properties that are not listed with real estate agents or land realtors, and say, “Hey man, I’m really looking at this tract. I want to know what you think about the hunting. What’s your history there? What do you know?” A lot of times I know the tract that they’re buying because of my contacts, and I’m always checking to see what’s available in our service area, hunting-wise.

These are long-term relationships and you have to know what you’re talking about to really help. From a conservation standpoint, I’ll get calls two or three years after we’ve made a loan with somebody, and they’ll say, “Our hunting has been a little rough, tell me what you’re doing.” Borrowers want to know what I think they need to do to help their deer herd, turkey flocks, or other wildlife on their property. I am by no means a biologist, but my experience gives me a pretty good idea of what I’m talking about when it comes to conservation.

If you’re going to specialize in recreational and timber land, I think your success depends on what you know. One of the biggest rewards I get is seeing our borrowers doing conservation work and developing great recreational tracts.

Can you tell whether someone has the time and energy to make an average piece of land better or if they really need to buy something ready to go?

Alex: That’s one of the questions I ask a potential borrower. What are they looking for? Do they want a bare property that’s step one on the drawing board? There are tracts like that out there that are a little cheaper, but what kind of time do they have?

You have to figure out their patience. And by getting to know them a little, you’ll learn that pretty quickly. A lot of times you don’t even have to ask. They’ll kind of insinuate what they’re looking for. People come in thinking “Hey, I’m getting a good deal on this piece of property.” That may be true, but do they know what it will take in order to turn the property into what they desire it to be? For example, if the borrower is a busy ER doctor, I might say to him, “Hey doc, I’d go with a tract that’s a bit more established.”

What has surprised you about working for Southern AgCredit?

Alex: One thing I searched for in all my years of real estate, from when I was working at the smaller agency in Madison to Mossy Oak Properties to 4 Corners, is a team-like atmosphere. Which isn’t to say that we did not have that in those places, but it’s different when people are working on commission-based projects like most real estate agents.

Being a college baseball player and a sports guy, you’re taught to rely on somebody else to do their part. At Southern AgCredit, the biggest thing that surprised me was that not only do we do that, we go above and beyond.

I can call on anybody in this whole association—I don’t care if it’s in Louisiana or all the way up in Greenville. I call not only my regional vice president, but somebody else who is in my position and ask about deals or how to structure them. I’ve only been here since 2015. Being able to rely on other folks at Southern AgCredit, soak in what they’ve learned, and have conversations is what got me to my position.

The success that Southern AgCredit has is not a surprise. The type of people who work here are not a surprise. What we do is not a surprise. But how we incorporate a team-like atmosphere and are able to rely on each other—that has been the biggest surprise and the biggest blessing. I honestly gave up on finding a job with a team-like atmosphere. I didn’t think it existed. But I finally found it at Southern AgCredit.

And heck, they stick up for you! I’ve got friends in the banking world who do not have it like we do at Southern AgCredit.

Why would you get a loan with Southern AgCredit and not another lender?

Alex: The first reason to come to Southern AgCredit is what we can do with financing compared to a commercial lender. Our product and process are just completely different from a commercial bank. When you walk into a commercial bank, they’ll have you fill out a form and call you in three days. At Southern AgCredit, you’re going to get much more than that. We don’t say, “Here’s a rate, here’s a term, and we’ll see you later.” We sit down and talk about what they really want and how we can help.

Why do you come to Southern AgCredit? We specialize in land and agricultural financing. That’s what we do. That’s our niche. Why would you go anywhere else? We’re going to have the best loan products and you’re going to be with me through the whole process: beginning, middle and end. That’s my passion in this. It’s a relationship-based transaction.

Contact Alex Riser at Southern AgCredit’s Gulfport Branch

If you are interested in financing for hunting and recreational land, a timber business, or any other agricultural need on the Mississippi Gulf Coast, Alex Riser’s branch is the one to call.

The Gulfport, Mississippi branch serves George, Hancock, Harrison, Jackson, Pearl River, and Stone counties. You can visit their newly improved office from Monday to Friday, 8:00 a.m. to 4:30 p.m. or give them a ring at (228) 832-5582.